Reaping the Benefits of

a Safer Workplace

Without a functional workplace safety program in place, you may be leaving your business vulnerable to above-average numbers of employee injuries, accidents, lost work time and even higher workers’ compensation insurance premiums.

The good news? With a little planning and investment of time and money, it’s not that difficult to set up a workplace safety program. A safety program is perhaps the most effective way to help ensure that your working environment is less prone to workplace injury and accidents or occupational disease that can impact productivity and drive up insurance costs.

The key to creating any effective workplace safety program is to know where to begin. Get started with these five steps:

- Understand how your workers’ compensation insurance premiums are calculated

A licensed ADPIA professional can help you understand the factors that affect your rates. Having this knowledge can provide your business with a strong foundation for taking intelligent, proactive steps to promote a safer workplace and help control premium costs.

- Document your workplace safety policies

These guidelines should include instructions on the proper ways to prevent accidents and address worker injuries, helping your business to:

- Create expectations

- Define authority

- Establish responsibility and accountability

- Inspect your worksite

Before you can prevent accidents and injuries from occurring, you need to determine what hazards currently exist. Businesses should first take a look at their most common injuries. Depending on your industry, this may include any of the following:

- Slips and falls due to insufficient lighting or poorly maintained floors

- Injuries from heavy or improper lifting techniques

- Persistent pain experienced from jobs requiring repetitive motion

Larger businesses may have a designated loss control specialist that handles inspecting for hazards, while smaller companies may look to their insurance carrier for guidance. At ADPIA, we've established strong relationships with carrier partners that can help our clients identify smart, cost-effective ways to improve workplace safety.

- Provide the right training

Often, workplace injuries occur because employees are not instructed on the proper way to perform their roles. Education is key to helping employees understand why safe practices are necessary, and can be an effective tool in minimizing and eliminating workplace hazards.

Prior to training employees, conduct an analysis of individual jobs with the following in mind:

- Identify the basic steps involved in the job

- Determine the potential hazards

- Propose safe work procedures and controls

- Analyze accidents and incidents

When accidents occur, companies should assess the associated hazard (for example, outdated equipment or a spill that was not adequately cleaned up) and make improvements as necessary. This can help your business:

- Identify patterns or recurring issues

- Make adjustments to avoid future occurrences

- Determine if employees are following safety procedures

- Strengthen the effectiveness of your safety program

Remember to include part-time and temporary or seasonal workers in your company's safety program. All workers must know what measures to take to ensure workplace safety.

Have questions on protecting your business? Call our Client Services Team today at (800) 524-7024.

OSHA Proposal Puts the Spotlight on Safety Performance

Workplace injuries and illnesses have declined over the last several years, according to the U.S. Bureau of Labor Statistics. While the downward trend is good news, a proposal by the Occupational Safety and Health Administration (OSHA) aims to make the numbers even better.

Last year, OSHA proposed requiring certain employers to submit their injury and illness survey data for posting online. Supporters of the proposal argue that public disclosure would put more pressure on companies to comply with workplace safety rules and allow employees and the public to identify businesses with poor safety records.

“Much of the [injury and illness] data never leaves the workplace, and we want to change that,” Assistant Secretary of Labor David Michaels said, adding the data will help the agency “better target” establishments with high injury rates, while allowing for “fewer inspections at employers with low rates of serious injuries.” 1

Michaels stressed that this is not an enforcement initiative but an “effective, non-prescriptive way to save lives and limbs.”

Certain employers are already required to keep OSHA injury and illness data, including:

- Employers under OSHA jurisdiction with 11 or more employees, unless the establishment is classified as a low-hazard industry such as retail,service, finance, insurance or real estate.

- Employers with 10 or fewer employees, including partially-exempt industries, if OSHA or the Bureau of Labor Statistics informs them in writing that they must keep records.

Under current practices, OSHA typically only reviews an employer’s data as part of an inspection, or the annual OSHA Data Initiative for high-hazard industries. These regulations currently cover approximately 750,000 employers with approximately 1.5 million establishments.

ADPIA works with many property & casualty carriers who can assist our clients in setting up a workplace safety program for your insured workers. For more information, call (800) 524-7024 to speak to our Client Services Team.

|

1) Press Teleconference on Proposed New Rule to Improve Tracking???of Workplace Injuries and Illnesses, Occupational Health & Safety Administration, November 7, 2013 |

|

The information contained herein represents the products and services available through only one of the business groups of Automatic Data Processing Insurance Agency, Inc. (ADPIA). ADPIA services mid and large size clients with various insurance products and services through its other business groups.

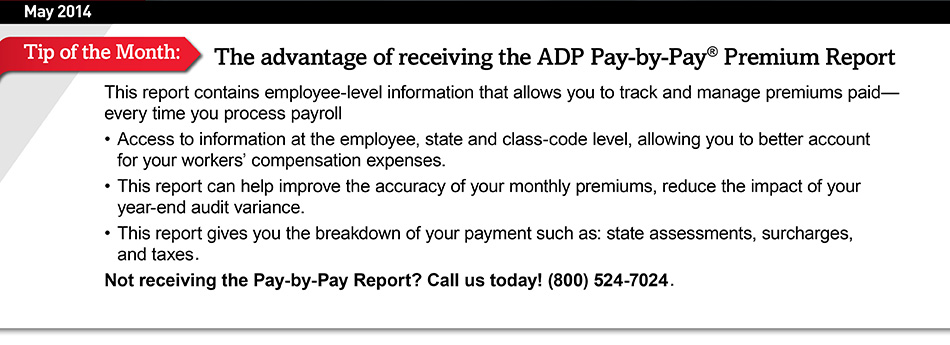

All insurance products will be offered and sold only through Automatic Data Processing Insurance Agency, Inc., its licensed agents or its licensed insurance partners; 1 ADP Blvd. Roseland, NJ 07068. CA license #0D04044. Licensed in 50 states. Certain services may not be available in all states. Some of these services are provided by the carrier partner of Automatic Data Processing Insurance Agency, Inc., and the carrier may charge an additional fee for services. Automatic Data Processing Insurance Agency, Inc. is an affiliate of ADP. ADP’s Pay-by-Pay is a payroll enhancement feature of ADP’s payroll processing services. Clients must be using ADP’s tax filing service to take advantage of the Pay-by-Pay Premium Payment Program. This information is general and not intended as tax or legal advice. If you have questions on how this may apply to your specific situation, please consult your tax or legal advisor. The ADP logo, ADP and Pay-by-Pay are registered trademarks of ADP, LLC. Copyright ©2014 ADP, LLC.